The global jigsaw blades industry is on a steady upward trajectory, boasting a 5.1% CAGR from 2026 to 2033. For professionals, DIY enthusiasts, and procurement teams alike, this growth isn’t just a number—it’s a signal of shifting market dynamics, evolving product needs, and new opportunities. But what’s really driving this expansion, and how can buyers navigate the changing landscape to make smart decisions? Let’s break down the key factors shaping the industry and address the questions that matter most to you.

Core Drivers Behind the 5.1% CAGR Growth

Two dominant trends are fueling the industry’s growth: the surge in DIY home improvement and the rising demand for precision tools in professional sectors. As remote work persists, more households are investing in home renovations, driving retail sales of jigsaw blades for custom cabinetry, trim work, and flooring projects. In 2025 alone, U.S. residential remodeling permits jumped 12%, directly boosting demand for versatile blade jigsaw options that handle wood, plastic, and light metal.

On the professional side, industries like metal fabrication, HVAC, and automotive manufacturing are upgrading to high-performance jigsaw blades to improve efficiency. The shift toward modular construction and has increased the need for blades that cut composite materials and thin-gauge metals cleanly— a gap that bi-metal and carbide-tipped jigsaw blades are filling.

Regional Market Dynamics: Where the Demand Lies

The global market isn’t one-size-fits-all, and understanding regional trends is critical for buyers sourcing globally. Asia-Pacific dominates the market with over 52% of global contributions, led by emerging manufacturing hubs like Indonesia and Vietnam. These regions have shorter tool replacement cycles and an annual procurement of $8.7 billion, making them key growth engines.

North America, meanwhile, is seeing increased market consolidation. Localization policies are pushing manufacturers to merge, with the top five players expected to hold 55% of the market by 2030—up from 38% in 2023. For buyers in this region, this means fewer suppliers but more streamlined, compliant options. Europe, under the EU’s Carbon Border Adjustment Mechanism (CBAM), is driving demand for green blades, with 30% of products required to meet low-carbon standards by 2025.

Supply Chain & Cost Considerations for Buyers

Raw material stability is a top concern for anyone purchasing jigsaw blades, as costs directly impact procurement budgets. The industry relies heavily on and tungsten carbide—materials with volatile pricing. In 2023, alloy element prices like molybdenum and vanadium fluctuated by 35%, pushing high-speed steel (HSS) costs up 18%.

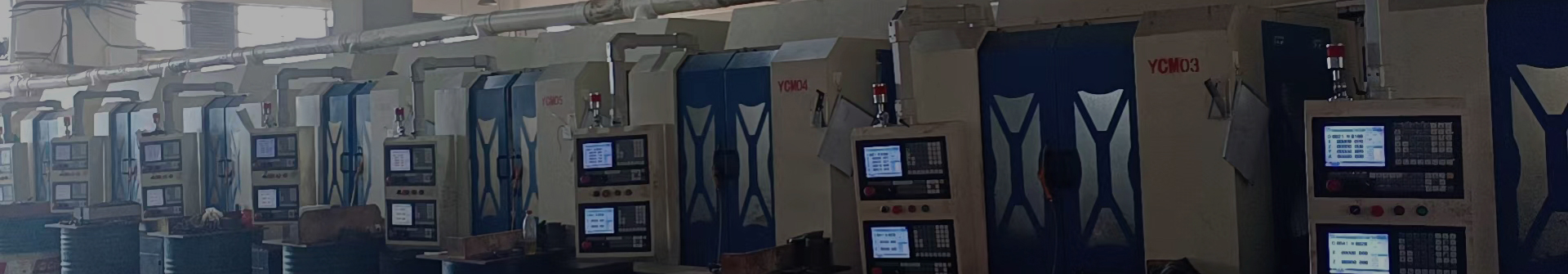

To mitigate risks, smart buyers are diversifying suppliers. China leads in basic tungsten carbide supply , but for ultra-fine grades, Japanese and German manufacturers still dominate. However, new from Chinese firms like Xiamen Tungsten Industry is breaking this monopoly, potentially lowering high-end blade costs by 12-15% by 2026. Regional supply clusters in China’s Yangtze and Pearl River Deltas also offer cost advantages, with 65% of global mid-to-high-end blades produced there.

Key Industry Shifts Impacting Buyer Choices

Technology and regulation are reshaping what buyers should look for in jigsaw blades. T-shank blades have become the industry standard, compatible with 90% of cordless jigsaws, replacing U-shank models in most professional settings. Anti-vibration coatings and heat-treated edges are now common features, extending blade life and improving cut quality—critical for high-volume projects.

Sustainability is no longer a niche concern. Blades made with recycled specialty steel and low-emission manufacturing processes are gaining traction, especially in Europe. Buyers should prioritize suppliers with ISO certifications and green manufacturing credentials to avoid compliance issues with CBAM and similar policies.

Practical Tips for Navigating the Market

For buyers, the 5.1% growth means more options—but also more complexity. Focus on material specificity: HSS blades for metal, bi-metal for versatility, and carbide-tipped for hard materials like fiberglass. Partner with suppliers in regional clusters for cost efficiency, but verify their ability to meet international standards .

Monitor emerging markets like Southeast Asia and the Middle East, where is driving demand. These regions offer opportunities for bulk purchases with shorter lead times, thanks to local production expansion.

The global jigsaw blades industry’s growth is rooted in real-world needs—from home DIYers to industrial manufacturers. By understanding the drivers, regional shifts, and supply chain trends, buyers can turn this growth into a competitive advantage, choosing blades that balance performance, cost, and compliance.

Post time: Jan-20-2026